ADVANCED WEALTH STRATEGIES

FOR ENTREPRENEURS

Chad Peterson’s Quantum Stack Investing™ method teaches real-world, revitalized strategies to buy, sell, & manage closely held companies and multiply your income + wealth.

For example, see the shocking truth Chad teaches about why you DON'T want to scale your business...

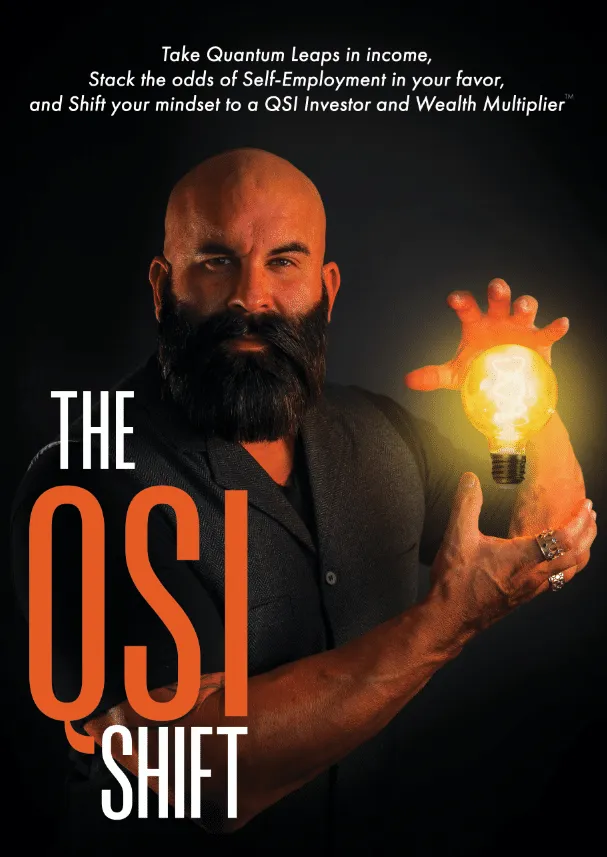

QUANTUM STACK INVESTING™

When it comes to investments, owning a closely held business is, and has historically been, the largest wealth builder in human history: even more than the stock market or real estate.

We’ll show you how QSI will turn typically-taught entrepreneurial methods completely on their head, increase your probability of success, and put the traditional rules used by banks to work in your favor (helping you make money like they do!). This can transform the approach to and results from your business.

NOW AVAILABLE ON AUDIBLE.COM

NOW AVAILABLE ON AUDIBLE.COM

NOW AVAILABLE ON AUDIBLE.COM

RELENTLESS ENTREPRENEUR, WEALTH STRATEGIST, AND RESILIENT LEADER

I am an entrepreneur, a businessman, and a visionary. I’ve built and sold multiple companies, mastering the art of buying, managing, and scaling businesses. My life is a testament to resilience, hard work, and a relentless drive to succeed.

I am an author, a speaker, a broker, and an investor, committed to helping others create wealth and transform their lives. My story is one of overcoming immense challenges, thriving under pressure, and finding strength in adversity.

I keep it real, work harder than anyone in the room, and share my hard-earned lessons to inspire others to take control of their own success.

LEARNING OPTIONS

GET COACHING

Chad's team of coaches are available to help you prepare your business to maximize its valuation and assure the biggest possible successful exit.

STUDY ALONE

Learn how to buy a business and run it profitably until you too are ready to sell it and make a successful exit of your own. Apply Chad's Quantum Stack Investing to build your wealth.

TOP PODCAST EPISODES

Digital Social Hour Podcast by Sean Kelly- The No-BS Guide to Selling Your Business Like a Pro

Dropping Bombs With Brad Lea - How to Buy a Business in 2025 (Even if You're Broke)

Prey Drive Podcast with Coach Michael Burt - Master the Art of Deal-Making

Dropping Bombs with Brad Lea - How to Turn Cash Flow into Long-Term Wealth

“Selling your business could be the fastest way to build massive wealth and reclaim your freedom.”

Chad Thomas Peterson

Chad Peterson is quickly becoming a rising star in the world of business, transforming the way entrepreneurs build wealth through his groundbreaking Quantum Stack Investing strategies.

With a unique approach to buying, scaling, and selling businesses, Chad’s insights are invaluable for anyone looking to take their financial future to the next level. See more of his expert advice and game-changing strategies when you subscribe to Chad’s YouTube channel today!

FOLLOW ME

© 2025 Chad Peterson | Privacy Policy | Disclaimer | Terms of Service

8700 Monrovia St., Lenexa, KS 66215 | (800) 845-0188

Disclaimer: ChadPeterson.com provides educational content only. No earnings claims or income guarantees are made—results vary and are not typical. Testimonials are individual experiences and not promises of success. This is not a business opportunity, MLM, or franchise offer. We do not offer legal, tax, or financial advice. Always consult with a licensed professional. Use of this site constitutes acceptance of our Terms, Privacy Policy, and full Disclaimer.

Some initiatives are operated under Misfit Ministries, a 508(c)(1)(a) faith-based, non-denominational spiritual organization focused on teaching higher consciousness, divine alignment, and entrepreneurial stewardship.

No part of this website may be reproduced or placed on any electronic medium without written permission from the publisher.

Information contained herein is obtained from sources believed to be reliable, but its accuracy cannot be guaranteed.

This site is not a part of the Google/Facebook website or Google/Facebook Inc. Additionally, this site NOT endorsed by or affiliated with Google/Facebook in any way. GOOGLE/FACEBOOK is a trademark of GOOGLE/FACEBOOK, Inc.

INCOME DISCLAIMER: This website and the items it distributes contain business strategies, marketing methods and other business advice that, regardless of referenced results and experience, may not produce the same results (or any results) for you. Perpetual Motion Marketing makes absolutely no guarantee, expressed or implied, that by following the advice or content available from this web site you will make any money or improve current profits, as there are several factors and variables that come into play regarding any given business. Primarily, results will depend on the nature of the product or business model, the conditions of the marketplace, the experience of the individual, and situations and elements that are beyond your control. As with any business endeavor, you assume all risk related to investment and money based on your own discretion and at your own potential expense.

LIABILITY DISCLAIMER: By reading this website or the documents it offers, you assume all risks associated with using the advice given, with a full understanding that you, solely, are responsible for anything that may occur as a result of putting this information into action in any way, and regardless of your interpretation of the advice. You further agree that Perpetual Motion Marketing, its affiliates, subsidiaries, officers and agents, cannot be held responsible in any way for the success or failure of your business as a result of the information provided. It is your responsibility to conduct your own due diligence regarding the safe and successful operation of your business. In summary, you understand that we make absolutely no guarantees regarding income as a result of applying this information, as well as the fact that you are solely responsible for the results of any action taken on your part as a result of any given information. In addition, you agree that our content is to be considered “for entertainment purposes only”. Always seek the advice of a professional when making legal, financial, tax, or business decisions.

The products being offered through this promotion are packages of informational tools to help you learn about business and deal making strategies.